Canada is the world’s fourth largest oil producer but 98% of its crude is shipped to the US but for the first time ever this 733-mile pipeline expansion is finally bringing Canadian Oil to new buyers across the ocean.

The critics argue that investments in a stalling oil industry hamstring the Canadian economy. Canada’s boom could also be a bust for the American refiners who have grown used to that cheap plentiful oil. here’s what’s at stake for the astronomically over-budget Trans Mountain pipeline expansion. What it could mean for Canada’s Global Ambitions and the world’s energy markets.?

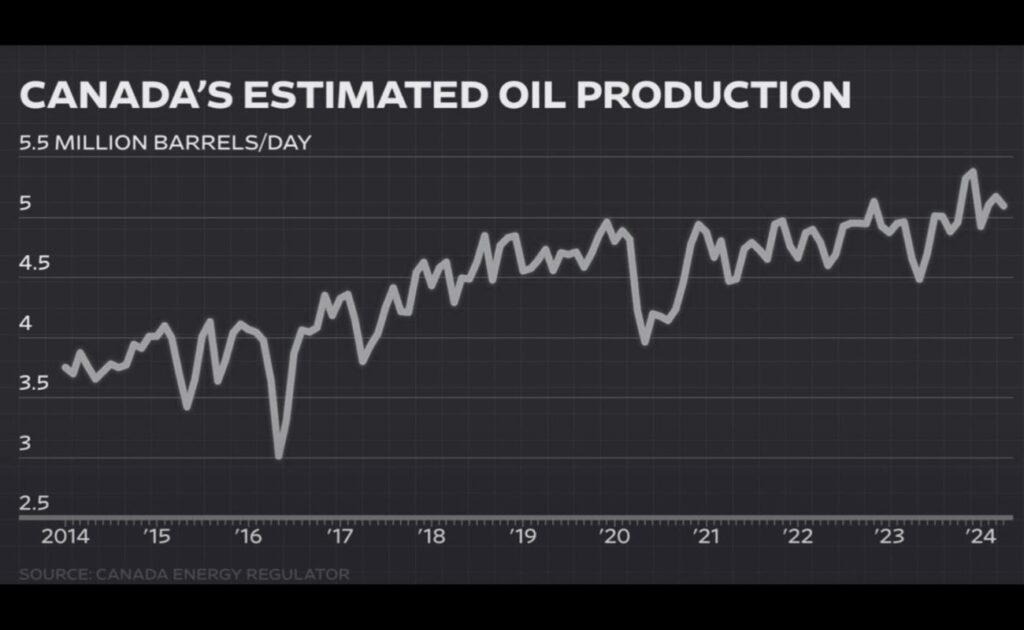

The oil and gas industry represents about 5% of Canada’s GDP. The energy sector is one of the only Industries in Canada that is growing. 95% of the country’s oil is produced here in western Canada. It’s home to Alberta’s oil where producers pump out millions of barrels of thick tar-like oil every day. But most of that oil ends up just across the border mainly in the midwest instead of other Global markets.

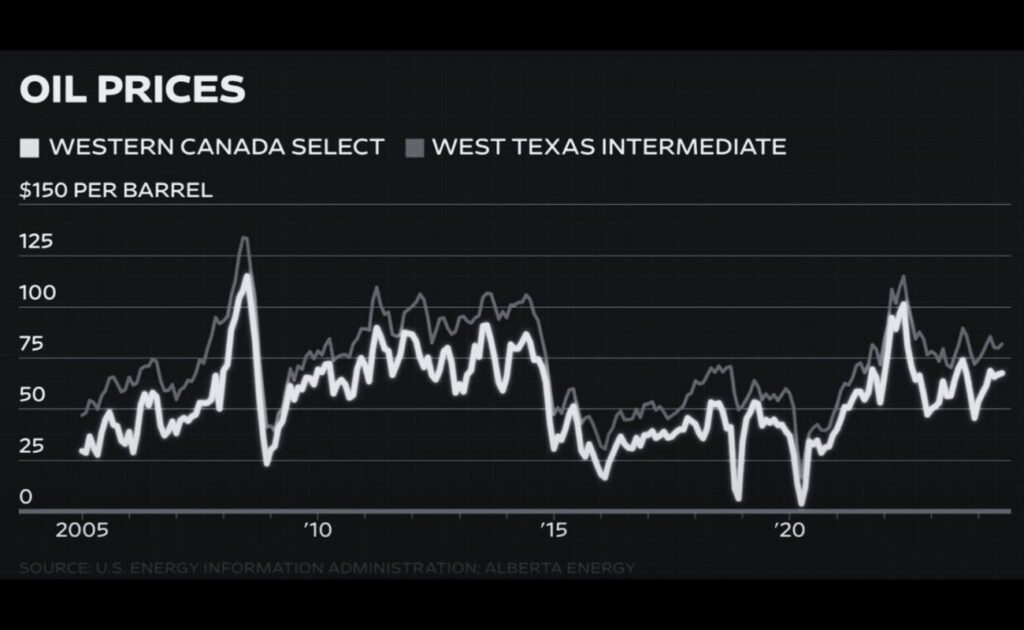

For a long time Canada was happy to send its oil to the US it’s a huge Market that has an insatiable energy demand. That created a relationship where each country relied on the other. Nearly all of Canada’s oil is exported to its neighbor and that oil makes up 60% of US imports. Pipeline advocates say that the heavy Reliance on a single Market helped push down Canadian crude prices for years.

Right now most of the world’s increasing demand is going to come from Asia. Canada has been trying to get its oil to those markets for a long time. The problem Alberta is here in the middle of the country and hundreds of miles away from either Coast.

The original Trans Mountain pipeline first built in 1953 was the only pipeline bringing oil from Alberta to the West Coast. so in 2013 Energy company Kinder Morgan filed an application to expand its capacity. At the time it was estimated to cost almost $4 billion but the project stalled for years facing intense opposition from environmental and Indigenous groups as well as mounting costs.

In 2018 the Canadian government stepped in to finish it buying the pipeline from Kinder Morgan. The project was ambitious aiming to open up exports to New Markets in Japan, China, and India by transporting more oil to a newly expanded Westridge Marine Terminal near Vancouver. it included almost 120 miles of reactivated pipeline 19 new storage tanks and three new shipping births. all to Triple the pipeline’s capacity to ship nearly 900,000 barrels a day. In the end, it cost the government $25 billion to build more than six times the original estimate.

That's always a big mistake when the private sector says hey this is too risky a project circumstances have changed. we don't think we're we want to build this the government and taxpayers should not come along and say okay we'll build it instead.

Thomas Gunton

Professor,Simon Fraser University

Thomas Gunton has analyzed the costs and benefits of projects like the expansion for decades. He estimates that taxpayers are subsidizing the cost of the project up to $14.9 billion.

A spokesperson for the Canadian Deputy Prime Minister and Minister of Finance said in a statement “The expansion will ensure Canada receives fair market value from resources. adding that the Bank of Canada estimates that it will contribute 25% to Canada’s GDP.

The project promised big returns for Canada making up $2.7 billion in Lost Revenue every year thanks to higher prices on the oil and an additional $34.5 billion in tax revenue. After 12 years of development and construction, the expansion opened at 70% capacity in May. but gains may not be as high as expected. The expansion also promised to alleviate another problem Canada’s growing oil sector faced a strain on the country’s export infrastructure as production increased.

Now with 600,000 barrels of increased capacity a day on the expanded pipeline. oil producers are shipping their products directly to markets including China and India. but that’s been a blow to the American refiners who have been used to Abundant access to discounted Canadian Oil.

In a comment, Philips 66 said that “it had great flexibility in its system that can move oil into its refineries at the right time”. The shift could send Ripple effects to consumers in the midwest. Some experts expect refiners to pass higher crude costs along to customers at the pump. Better oil prices and more customers outside of the US also mean a bigger geopolitical role for Canada.

The expansion isn’t guaranteed to wean Canada off the US entirely. Thanks to its geographic isolation. That’s partly because of heavy opposition from environmental and First Nation groups. Trudeau whose approval rating has slipped came under Fire for his support of the pipeline expansion at the same time as he pushed to fight climate change.

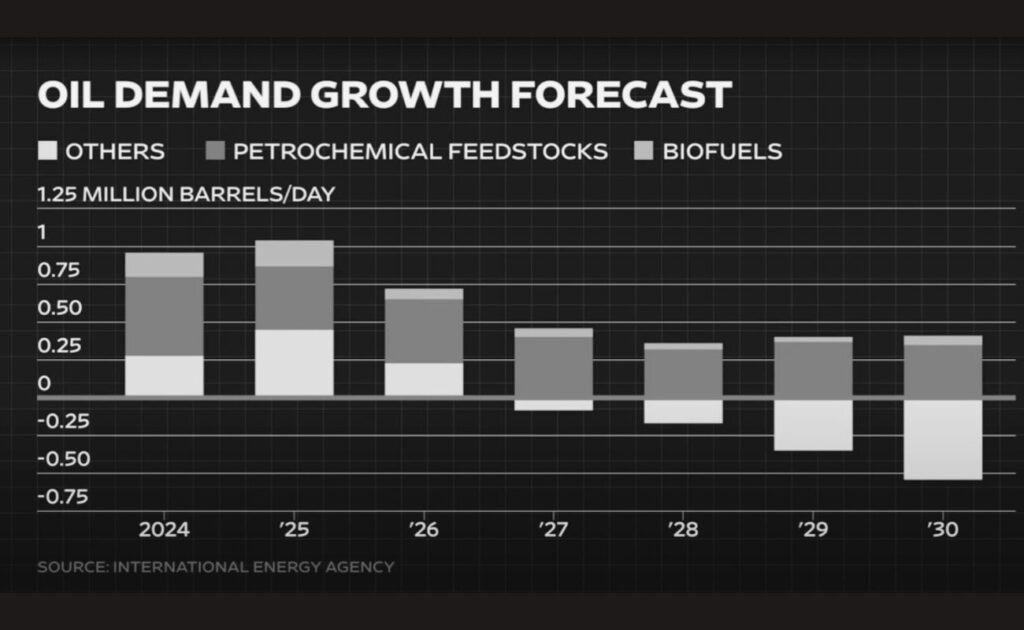

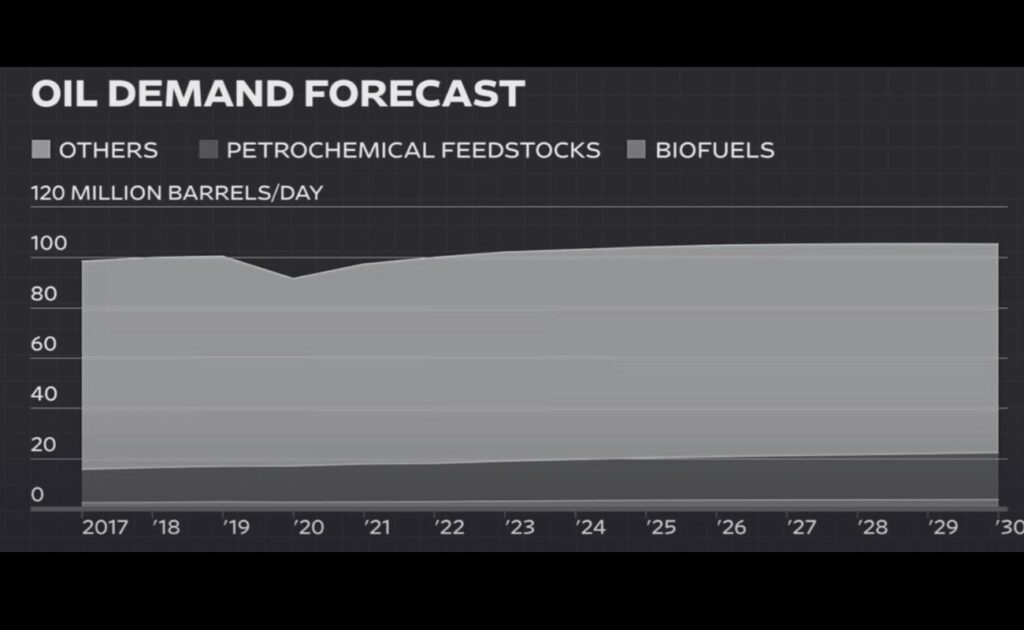

The growth of oil demand slows around the world amidst a clean energy transition. critics warn of the long-term prospects of the pipeline expansion. The world is moving away from oil how fast it’s going to move away is up for discussion but it’s moving away from oil and these pipelines are going to be in trouble. Because there’s not going to be enough oil demand to fill up the pipelines to generate the revenue required to pay for them.

For now, though Canada is hoping that there will always be some demand for the 170 billion barrels of crude in Alberta’s oil sands Particularly in developing areas of the world. The projections show that despite growth decreasing oil demand itself Will Rise by the end of the decade.

Take the example of coal. people have been expecting coal to be phased out as people reduce the use of coal for producing power whatnot. The world is using more coal right now than it ever has in history the sense is that it’ll be the same for oil